The LO Compensation feature in Encompass enables companies to set up and track compensation paid to loan originators (loan officers, third party originators (brokers)) or the compensation being paid to your company by a wholesale lender if your company is acting as the broker. The feature includes an administrative setting for creating LO compensation plans, a setting for assigning plans to lenders and third-party originators (brokers) outside of your company, and an LO Compensation tool to allow authorized individuals to view and manage the

compensation being paid, to whom, and how the compensation amount is documented in the loan file.

NOTE: The LO Compensation tool and its associated compensation plan administrative settings are available in Encompass Banker Edition only.

Credit for the video goes to Encompass.

LO compensation will never be applied to the Correspondent loan channel.

Open loan file-> click tools tab-> and then click lo compensation

lo compensation tool is displayed

————

who pays – Borrower / Lender / exempt

Trigger field – 745 (application date)

Channel – correspondent is exempted

who can get it – Loan officer / Broker

compensation can be paid by Lender if our company works as a broker

———–

how it can be given – minimum/maximum can be decided

% of the loan amount can be decided

a fixed amount can be decided

———

in admin settings, when the date entered in this date field means the trigger date field is the same or later than the start date for the compensation plan(and the date occurs before the plan end date), the plan will be applied to the loan. Minimum term # days is the minimum no of days in which the plan will be in effect. If an administrator tries to assign a different plan to an originator before the minimum term is over, they will receive a warning message telling them that the start date for the new plan occurs before this plan has ended. At that point, they can proceed with assigning the new plan or cancel the operation.

————

The compensation Plan details section applies to all types of compensation plans, providing basic details about the plan set by admin in settings under Tables and Fees -? Lo compensation

wholesale/broker plan details and plan calculations sections display the compensation our company is paying to third-party originators or the compensation a lender is paying to our company if it is acting as the broker

These sections will be used for loans in our banked-wholesale or brokered loan channels

The loan officer plan details and plan calculations sections show the compensation our company is paying to the loan officer. These sections will be used for loans in our banked-retail loan channel.

These sections will also be used for loans in our brokered loan channel when our company is acting as the broker to show the compensation being paid to the loan officer who originated the loan.

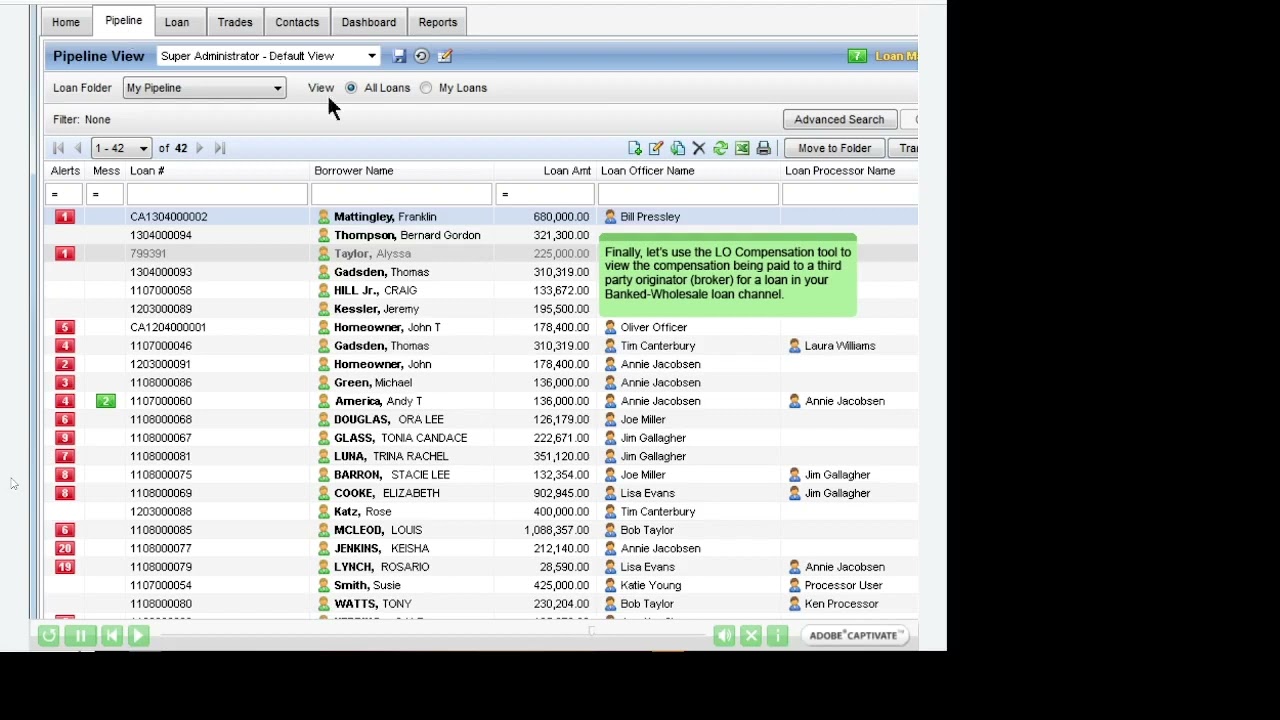

Now come to the pipeline and first let’s use the LO compensation tool to view the compensation for a loan officer

In order for the compensation plan assigned to the loan officer to populate here, the following loan data is required.

Channel (field id 2626

Loan originator – (in this case) this is the loan officer for the loan (field id 317)

Trigger field date – The date is the date entered in the trigger field. This date must occur on or after the compensation plan’s start date (and before the end date).

Since the required fields are populated, the compensation plan for the loan officer is displayed, here the compensation percentage and dollar amounts are displayed, click a lock icon to manually update the base plan fields (if authorized by administrator), use the bonus computation field to enter additional compensation owed to the loan officer, use adjustment credit fields to apply portions of compensation towards fees owed by the borrower, after entering adjustment credit, enter an explanation for the adjustment

now if at any time a different loan officer is assigned to the loan, the loan officer plan details fields are not updated with the new loan officer information automatically, to recalculate the fields using the LO compensation plan assigned to the new loan officer, click the reset comp button – the loan officer plan details and plan calculations are updated with the new loan officers compensation, note that if there is no compensation plan assigned to the new loan officer, a warning message displays. If you choose to continue with the reset, all of the compensation fields in the tool will be cleared. If the loan channel is changed or if a new plan is assigned to the loan officer, you must use the Reset comp button to recalculate the compensation plan fields.

Now let’s use the LO compensation tool to view the compensation being paid for a loan in our brokered loan channel

Since only one of the required fields is populated, compensation plan data is not displayed in the tool.

When working with the brokered loans, we must also indicate the lender for the loan, to select the lender click on the lookup icon, and then double click the lender name, note that only lenders that have been added to the external company setup settings are available to select, and now we can see that the compensation fields are populated based on the compensation plan assigned to the lender. The Plan calculations section displays the compensation being paid to our company by the lender. Authorized users can edit the Base Plan fields and enter adjustment credits. The compensation is paid to the loan officer by our company displayed here.

Finally, let’s use the LO compensation tool to view the compensation being paid to a third-party originator (broker) for a loan in our banked-wholesale loan channel. The wholesale/broker plan details and plan calculations section display the compensation our company is paying to the third-party originator. Note that o data is displayed for loan officer compensation since it is not applicable for banked wholesale loans. Use the adjustment credit fields to apply portions of compensation towards fees owed by the borrower. After entering adjustment credit, enter in adjustment description about explanation. Please note, that if any loan data changes, such as the total amount of the loan, the compensation fields will automatically recalculate the next time you open the LO compensation tool. However, if the loan channel changes or the originator changes, or a different compensation plan is assigned to the originator, we must click Reset Comp to recalculate the compensation fields.

Now let’s see how to pull broker compensation directly from the LO compensation tool into the 2015 itemization form. After viewing or recalculating the compensation paid to a broker in the LO compensation tool, we can pull this compensation data to the 2015 itemization input form. To start click the itemization link. Select the Use LO comp tool check box located on the broker compensation line in section 801. The base plan data from the tool is pulled into the broker compensation field and line 801 is recalculated accordingly. In some circumstances, the compensation percentage and/or the flat charge will not match the corresponding fields in the LO compensation tool. When necessary, Encompass360 automatically adjusts the compensation percentage and flat charge on the 2015 itemization so that when they are added together the total compensation paid to the broker on the input form matches the total compensation on the LO compensation tool. In this example, the compensation plan for the originator rounds the total amount to the nearest dollar. Since values are not rounded on the 2015 itemization and since the compensation percentage is 2.5%, a $.50 flat charge was added to the 2015 itemization to ensure the total compensation being documented for the loan is 8033. that’s another good example of adjustment is in we can see in the LO compensation tool, here we will add a $100 adjustment credit towards an inspection fee and now if we would see in itemization, the compensation percentage and flat charge are both recalculated to ensure the total broker compensation being paid is correct.

Scenarios when these adjustments may occur include when:

– the compensation plan is based on the base loan amount instead of the loan amount

– the compensation plan is set to round to the nearest dollar

– adjustments credits are applied

– percentages in the LO compensation tool are calculated to five decimal places (2015 itemization allows for only three decimal places).

One more thing to note here in itemization is that when broker compensation data is pulled into the 2015 itemization, the 802 section is also updated. As are the applicable fields in the Manage Adjusted Origination Charge Details Window.

Credit for the video goes to Encompass.